change in net working capital as a percentage of change in sales

Which is same as of revenue. While one company uses this working capital to generate sales of USD 500 the other uses the same amount as working capital to generate USD 1000 in sales.

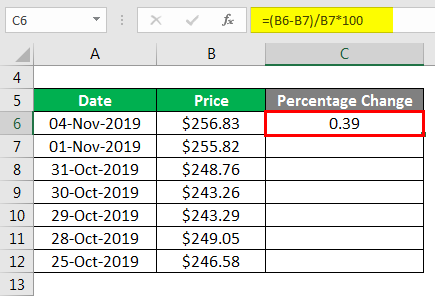

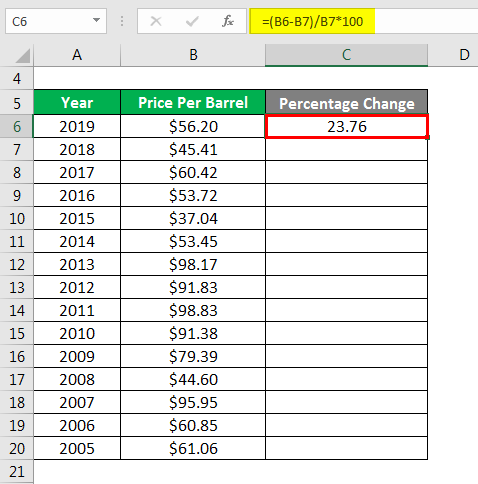

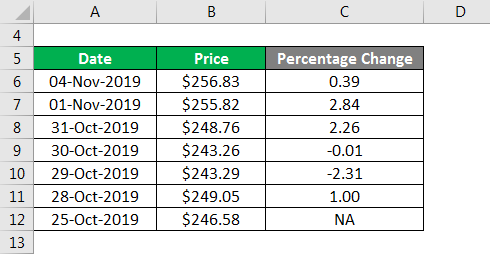

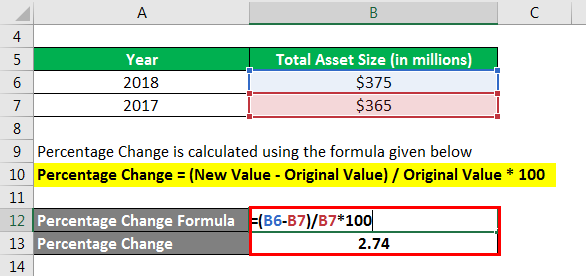

Percentage Change Formula Calculator Example With Excel Template

On the Cash Flow Statement the Change in Working Capital is defined as Old Working Capital New Working Capital where Working Capital Current Operational Assets Current Operational Liabilities.

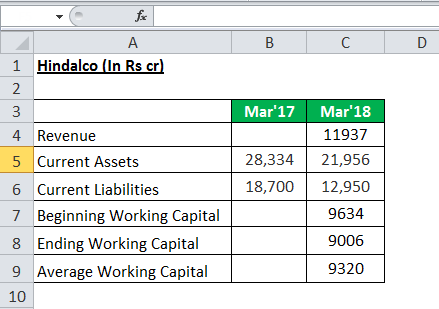

. Using the same method as quarter one we can calculate net sales and working capital again for quarter 2. Changes in Net Working Capital. Working Capital Turnover Net Sales Average Working Capital.

Related to Working Capital as a Percentage of Sales. Consider two companies both having the same working capital of USD 100. Compare the ratio against other companies in the same industry for additional insights.

As used herein NWC means a the Net Book Value of the current assets of the Business listed on Section B-2 of the Disclosure Schedule less b the Net Book Value of the. The quarter 2 ratio is 182. Change in Working capital does mean actual change in value year over year ie.

You could allow working capital to decline each year for the next 4 years from 10 to 6 and once this adjustment is made begin estimating the working capital requirement each year as 6 of additional revenues. If the result is too high eg more than a ratio of 11 the company you are analyzing might be having trouble converting inventory to sales or not enforcing. Change in Working Capital Summary.

Change in Net Working Capital Formula. If change delta nwc 5 of revenue if revenue increases delta nwc increases proportionally. The sales to working capital ratio is calculated by dividing annualized net sales by average working capital.

In general the higher the number the more financial risk is involved in company operations as it takes a higher degree of assets to run short-term operations. The forecasted sales figure for the year 2015 is 600. If a company borrows 50000 and agrees to repay the loan in 90 days the companys working capital is unchanged.

As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year. Consider the following balance sheet for the year 2014 as an example. You can express the ratio as a percent that tells you what percentage of net working capital you have out of all incoming cash flow.

The quarter 4 ratio is 235. Net sales 24675. Table 1012 provides estimates of the change in non-cash working capital on this firm assuming that.

If a company sells merchandise for 50000 that was in inventory at a cost of 30000 the companys current assets will increase by 20000. Annualized net sales Accounts receivable Inventory - Accounts payable Management should be cognizant of the problems that can arise if it attempts to alter the outcome of this ratio. The Change in Working Capital is defined as a difference between the two different-period net working capitals.

For working capital add the accounts receivable 8333 and inventory 12500 then subtract accounts payable 1042. Now lets break it down. Now changes in net working capital are 3000 10000 Less 7000.

For example tightening credit reduces sales. The quarter 3 ratio is 205. Stating the working capital as an absolute figure makes little sense.

Working Capital 11011. Change in NWC Formula. The business would have to find a way to fund that increase in its working capital asset perhaps by selling shares increasing profits selling assets or incurring new debt.

Thus if net working capital at the end of February is 150000 and it is 200000 at the end of March then the change in working capital was an increase of 50000. Therefore working capital will decrease. But it means the change current assets minus the change current liabilities.

Net sales 23500. Its defined this way on the Cash Flow Statement because Working Capital is a Net Asset and when an Asset increases the company. If no other expenses are incurred working capital will increase by 20000.

First each component of working capital as a percentage of sales is calculated. Hence there is obviously an assumption that working capital and sales have been accurately stated. Changing working capital does mean actual change in value year over year.

The change in working capital value gives a real indication on why the working capital has increased or decreased. For instance if a companys current liabilities are 1890000 its current assets are 2450000 and its total assets equal 3550000 the company can find its net working ratio like this. Target Net Working Capital Amount means an amount equal to the four 4 quarter average NWC as defined in this paragraph for 2015 for the Business.

Percentage of Sales Method Example. Now changes in net working capital are 3000 10000 Less 7000. The formula is working capital divided by gross sales times 100 For example if working capital amounts to 140000 and gross sales are 950000 working capital as a percentage of sales is 1474 percent.

Net Sales Total Revenue - Cost of Sales Returns Allowances Discounts You then calculate the turnover ratio. CHANGE IN NET WORKING CAPITAL NET WORKING CAPITAL FOR CURRENT PERIOD. Net sales 25909.

The sales for 2014 are 400. Change in Net Working Capital NWC Prior Period NWC Current Period NWC. Working Capital to Sales Ratio Working Capital Sales.

Percentage of Sales Method Formula Component of Working Capital 100 Sales of the Year. Working capital as a percent of sales is calculated by dividing working capital by sales.

Change In Working Capital Video Tutorial W Excel Download

Change In Working Capital Video Tutorial W Excel Download

Changes In Net Working Capital All You Need To Know

Percentage Change Formula Calculator Example With Excel Template

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Meaning Formula Calculation

Change In Working Capital Video Tutorial W Excel Download

Working Capital Turnover Ratio Meaning Formula Calculation

Percentage Change Formula Calculator Example With Excel Template

Change In Working Capital Video Tutorial W Excel Download

Training Request Form Template Lovely Time Off Email Template Maybemanifestofo

Percentage Change Formula Calculator Example With Excel Template

Business Card Templates Word Free Business Project Plan Template Credit Applicat Free Business Card Templates Business Plan Template Business Proposal Template

How To Calculate Working Capital Turnover Ratio Flow Capital

Percentage Change Formula Calculator Example With Excel Template